We see opportunity where others see complexity. Kingwest funds are for clients who want focused and patient investing that’s not closet indexed, but truly differentiated.

Our approach creates tangible benefits for your clients.

Better access matters. You have direct access to portfolio managers. When you call, you speak with the people managing your clients’ capital.

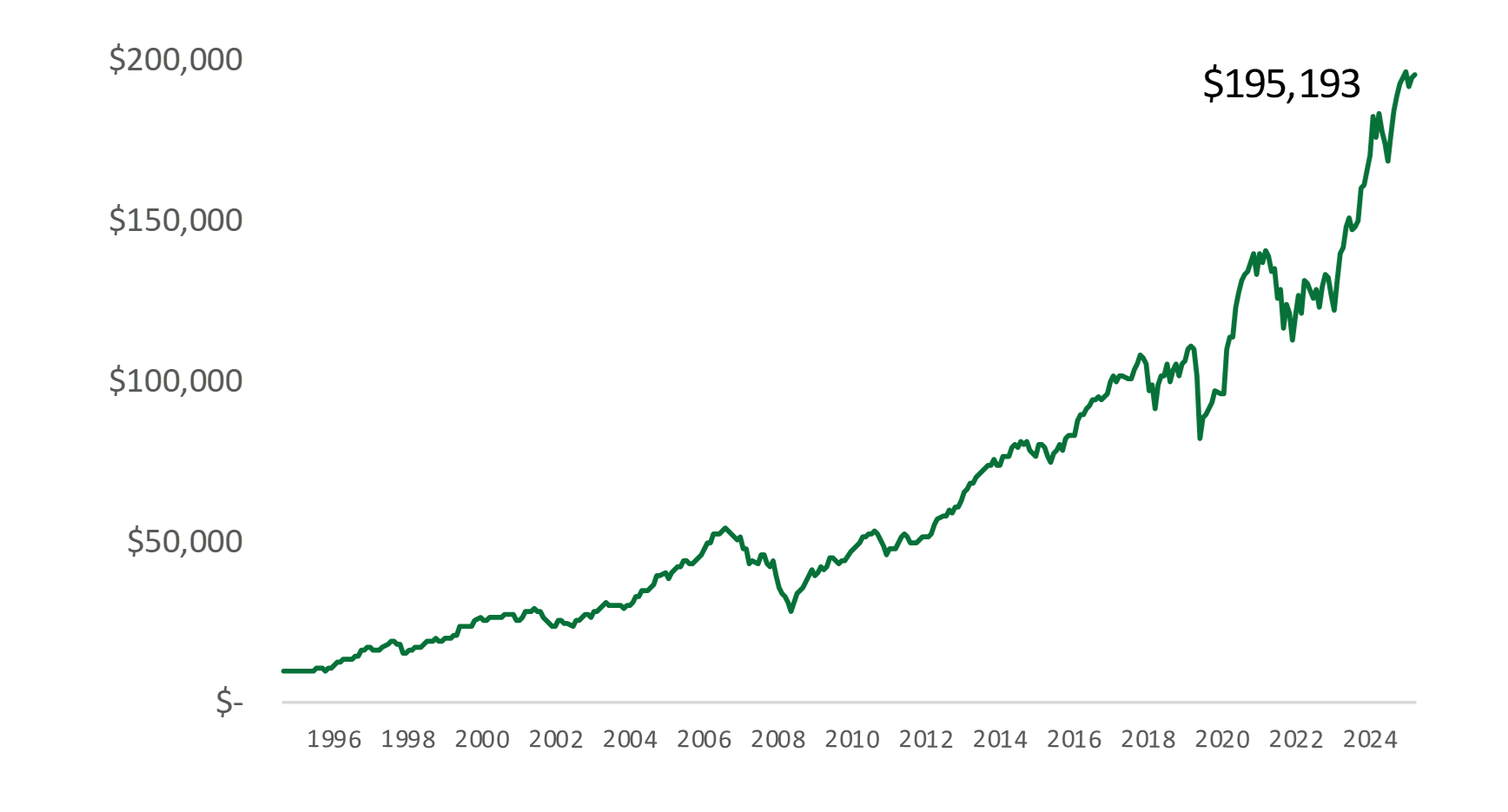

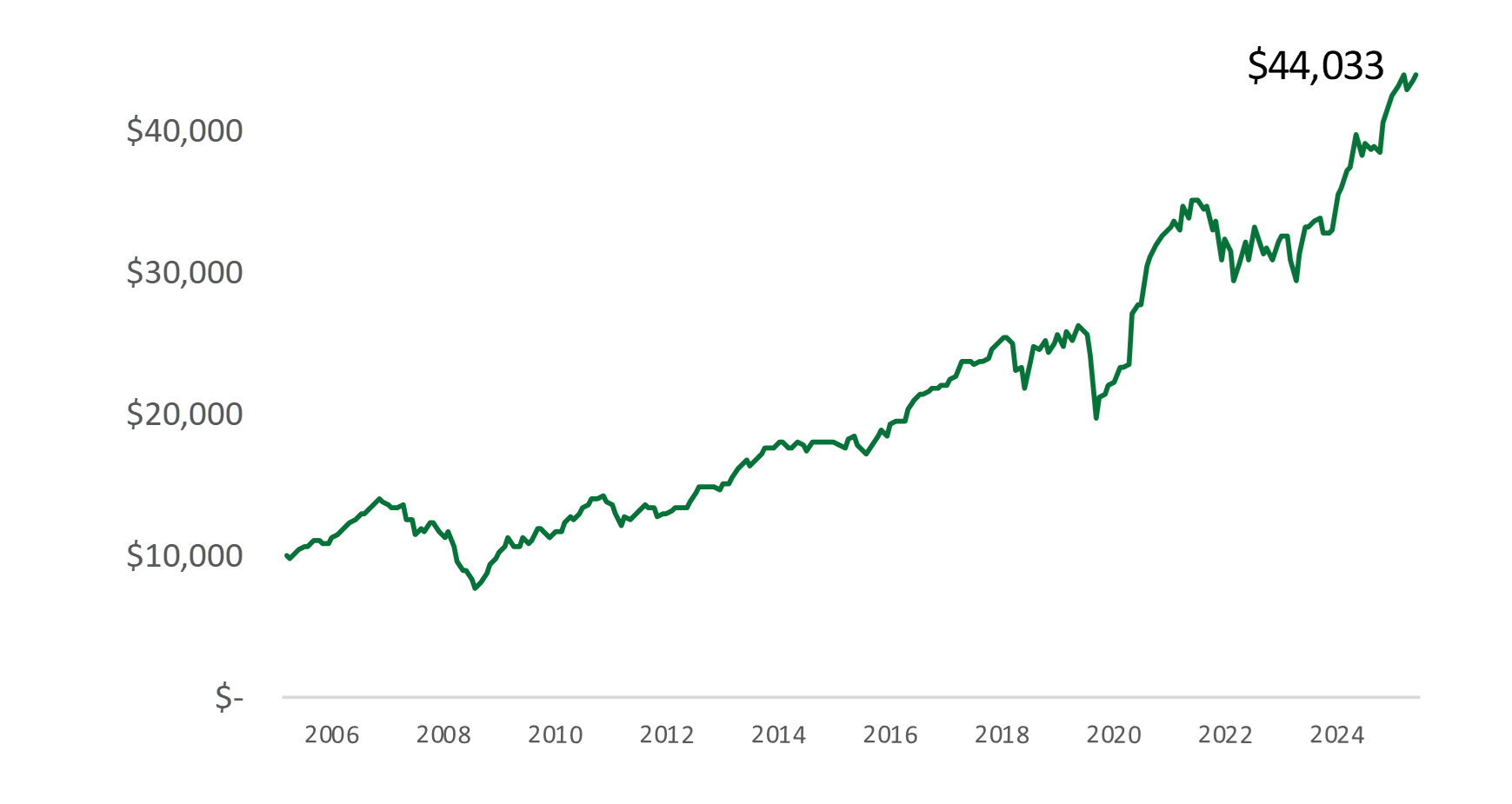

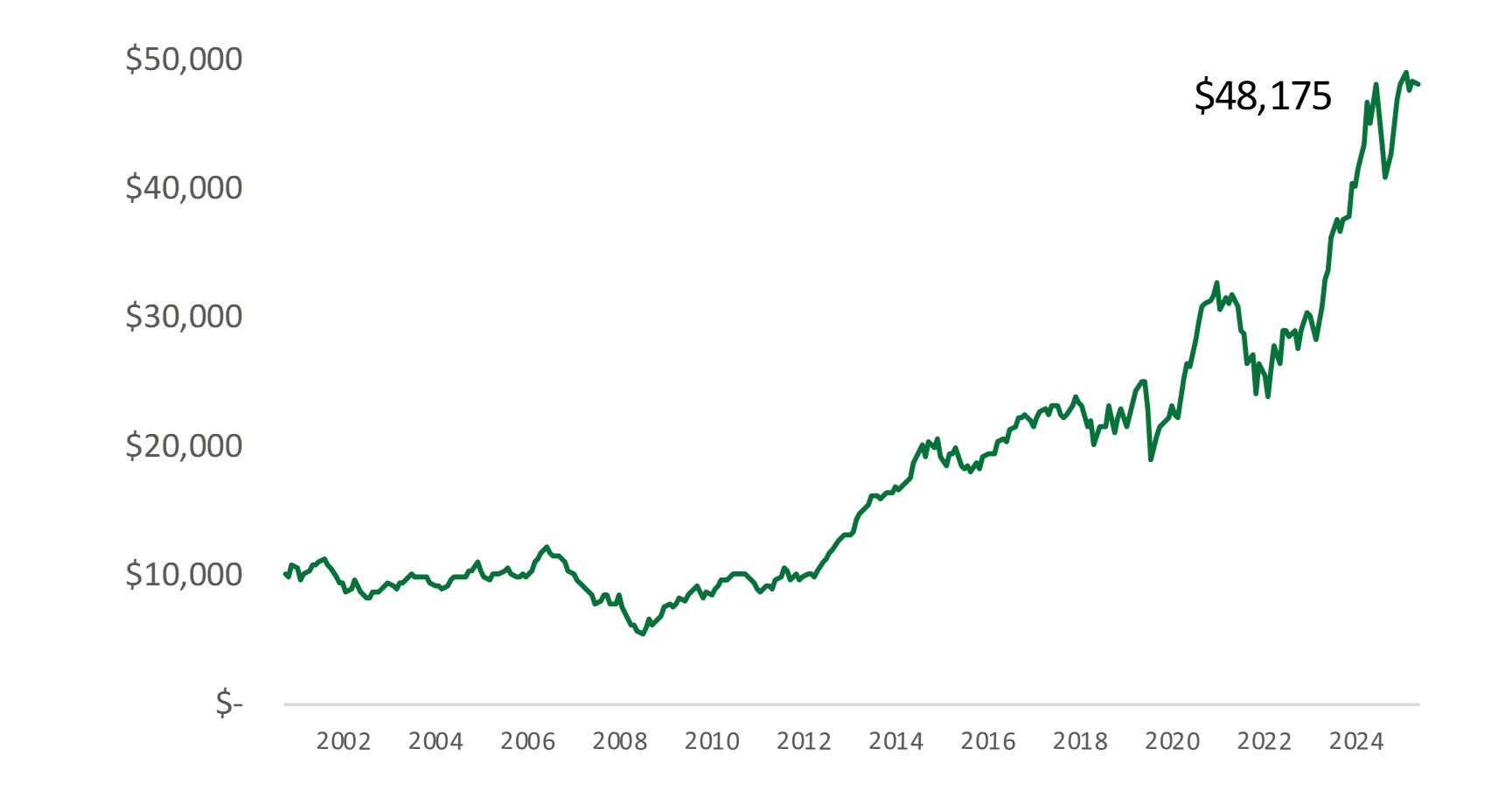

Stability matters. We are an independent investment firm founded in 1982 with one of the longest continuous track records of any mutual fund.

Taxes matter. Low turnover means compelling tax benefits.

Deep knowledge matters. We own 25 companies we know intimately, not a broad list we know superficially. Clients value risk reduction.

We own what your clients own. Same risk. Same reward.

Sean Hayes | +1-(416) 927-7740 | funds@kingwest.com